The income approach to value is based on the principle of anticipation and is relied upon heavily when appraising commercial and investment properties. To calculate the NOI start by annualizing the propertys rental income and subtracting a vacancy.

What Is Income Approach Definition Meaning Example

What Is Income Approach Definition Meaning Example

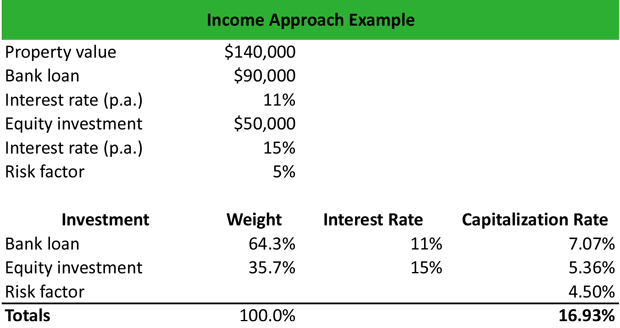

Determining the capitalization rate.

Income approach to value formula. The income approach attempts to calculate the present value of the projected future income flow arising from the subject IP patent during its economic life. On its face this method is incredibly simple. Revenue or income associated with the use of the IP.

With the income approach a propertys value today is the present value of the future cash flows the owner can expect to receive. Required Rate of Return. When using the Income Approach particular attention is paid to five main parameters that determine value.

Determine the appropriate Capitalization Rate. There can be many adjustments to the projected cash flows that can have a profound impact on the present value figure. This formula has another name.

This present value figure is the basis for a sale price. Calculate a Pro FormaStabilized Net Operating Income. The income approach is an application of discounted cash flow analysis in finance.

1 Expenditure Approach There are three main groups of expenditure household business and the. GDP is Gross Domestic Product and is an indicator to measure the economic health of a country. In this formula there are three necessary steps.

All calculations in this approach should be annualized. Since it relies on receiving rental income this approach is most common for commercial properties with tenants. TNI Sales Taxes Depreciation NFFI where.

The income approach is an application of discounted cash flow analysis in finance. Total Amount of Capital Debt Equity According to Net Income Approach change in the financial leverage of a firm will lead to a corresponding change in the Weighted Average Cost of Capital WACC and also the value of the company. Under the capitalization of earnings approach no growth in cash flows is considered.

Theres an inverse relationship between the asking price and cap rate. Net operating income I capitalization rate R value V You can break this formula down into these three steps. Using Capitalization Rate Cap Rate to Estimate Value The net operating income of the property is used when the capitalization rate is employed to value an income property.

Same thing different words. Steps to Completing a Valuation via the Income Capitalization Approach. This is the number of years it will take the income of 10000 to add up to the capital value reflecting the time value of money.

TNI Total national income NFFI Net foreign factor income beginaligned textTNI textSales Taxes textDepreciation textNFFI. Net Operating Income Cap Rate Value. The present value of 1 per annum and this means the current value of the right to receive 10000 income for 4 years.

The income approach is a methodology used by appraisers that estimates the market value of a property based on the income of the property. Its calculated by dividing the net operating income by the capitalization. The basic formula for estimating value with the income approach is net operating income NOI divided by the capitalization rate Cap Rate.

The income approach is a methodology used by appraisers that estimates the market value of a property based on the income of the property. There are five steps in the income capitalization approach to value. Under the capitalization of earnings method value of a business is determined by discounting its future earnings.

Required Rate of Return x Amount of Equity Cost of debt x Amount of Debt. With the income approach a propertys value today is the present value of the future cash flows the owner can expect to receive. Applying the IRV formula to arrive at a value estimate.

Estimate potential gross income PGI 2. Calculate the net operating income NOI Determine the capitalization rate. In other words the higher the cap rate the lower the asking price.

To calculate equity value from enterprise value subtract debt and debt equivalents non-controlling interest and preferred stock and add cash and cash equivalents. Formula to Calculate GDP. Net Operating Income Cap Rate Property Value.

Investors use this calculation to value properties based on their profitability. Since it relies on receiving rental income this approach is most common for commercial properties with tenants. Equity value is concerned with what is available to equity shareholders.

The basic formula for this approach commonly referred to as IRV is. Estimating the net operating income. The income approach is a real estate valuation method that uses the income the property generates to estimate fair value.

What Does Income Approach Mean. Divide the Net Operating Income by the Cap Rate to arrive at an estimated value. Income Approach Create a forecast of the expected cash flows of the business for at least the next five years and then derive the present value of those cash flows.

What is the definition of income approach. Income approach is a valuation method used for real estate appraisals that is calculated by dividing the capitalization rate by the net operating income of the rental payments. The formula to calculate GDP is of three types Expenditure Approach Income Approach and Production Approach.

The income approach only works if you have an accurate net operating income for the property.