The focus of this stage is to make sure that the action item created in the Improve phase is well-implemented and maintained. Thus virtually no output is out of specification.

Control Chart Limits Ucl Lcl How To Calculate Control Limits

Control Chart Limits Ucl Lcl How To Calculate Control Limits

Formulas for Control Limits The following formulas are used to compute the Upper and Lower Control Limits for Statistical Process Control SPC charts.

Control limits six sigma. Viewing 4 posts - 1 through 4 of 4 total. Matt did you ever come up with a solution that properly sets control limits at plus and minus 3SD from the mean automatically based on data. We can have the upper warning line and lower warning limit also.

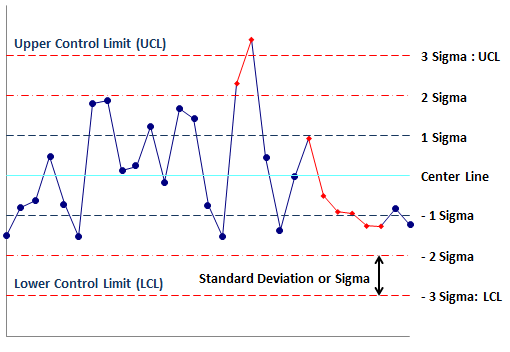

Control limits are the limits of expected variation of either individuals data or sample subgroup data. The upper control limit and lower control limit are three standard deviation distance from the center line in both sides. If this condition is met this means that a degree of perfection of almost 100 is in place.

Specification limits are the targets set for the processproduct by customer or market performance or internal target. If you are plotting range values the control limits are given by. Six Sigma DMAIC Charts Control charts can be used for various things including determining process stability monitoring processes finding the root causes of special variations or assignable causes that go outside the expected control limits predicting a range of process outcomes and analyzing process variation patterns.

Six Sigma therefore stands for six standard deviations. Note that specification is not used in control charts because it has nothing to do with stability. Activities such as checking the.

Six Sigma iSixSigma Forums Old Forums General Control Limits This topic has 3 replies 4 voices and was last updated 18 years ago by tottow. One way that a six sigma practitioner can determine whether or not they have a smoking gun meaning that they have unexpected variation is if a point goes out of control on a control chart. Remove those subgroups from the calculations.

If the points are out of control in R chart then stop the process. So for each set of control limits there is a location parameter and a dispersion parameter. You may also like.

The location parameter simply tells us the average of the distribution. A process operating at 6 sigma means that the process average is 3 sigmas away from the closest specification limit 3 from the UCL and 3 from the LCL. Several tools are used in this stage to make sure that variables are within its limits.

Statistical Process Control Overview. Control limits are statistical process control tools which allow you to determine whether your process is stable and in control or trending towards increased variability which could lead to defects in the end product. Control charts in theory are used in product and process development to analyze processes.

Identify the special cause and address the issue. The six sigma quality system relies heavily on statistical process control or SCP and statistical analysis. Six Sigma is a philosophy and a mindset for quality improvement used by companies and organisations.

In concrete terms Six Sigma means that the companys processes maintain six standard deviations from the mean value of the process to the nearest tolerance limit. The last phase of Six Sigmas DMAIC model is the Control phase. The X bar chart control limits are derived from the R bar average range values if the values are out of control in R chart that means the X bar chart control limits are not accurate.

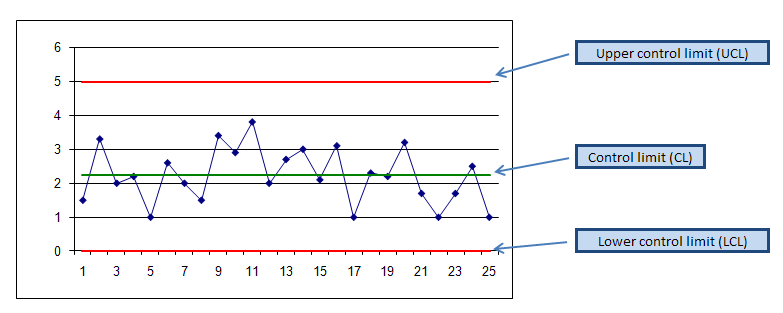

Use this chart to determine the Upper Control Limit UCL and Lower Control Limit LCL for a Xbar-R chart. In the control chart these tracked measurements are visually compared to decision limits calculated from probabilities of the actual process performance. Mean and Range Xbar-R chart is used when you have Continuous data with a Sample Size of less than eight.

Typically the acceptable limits of variation equates to what one would expect to see in a random process 9973 of the time. Control limits on the other hand are the indicators of the variation in the performance of the process. The one which alarms us if data points crossing this limit this can make the process unstable.

Manage Control Limits When Implementing Statistical Process Control 1554 By Rufina Scott 0 Comment. Methodology Six Sigma Control Chart Construction. Yes Control limits and Specification limits are different.

Now the question is which is the two standard deviation in distance from the central line. Control Limits for Xbar-R chart - Benchmark Six Sigma Control Limits for Xbar-R Chart Hint. DMAIC A Six Sigma Process Improvement Methodology.

In short it is the intended result on the metric that is measured. UCL AverageR 3SigmaR LCL AverageR - 3SigmaR where AverageR average of the range values and SigmaR standard deviation of the range values. Statistical process control SPC is the application of statistical methods to identify and control the special cause of variation in a process.

This is the required minimum clearance of the tolerance limit. Sigma Greek letter σ refers to the standard deviation from the mean value. The method focuses on minimising waste by minimising variations in processes.

The primary Statistical Process Control SPC tool for Six Sigma initiatives is the control chart a graphical tracking of a process input or an output over time. SPC Objectives benefits Shewhart control charts Variations Common cause variation random variation Special nonrandom variation Variables Attribute Selection of Variable Rational Subgrouping Schemes Sources of Variability. Values for A2 A3 B3 B4 D3 and D4 are all found in a table of Control Chart Constants.

Just came by this thread looking for PowerBI tools for typical DMAICSix Sigma type statistical visualizations.

Who can receive a distribution for K-12 tuition. For a prepaid tuition plan the states limit is a limit on the total contributions.

How Much Is Your State S 529 Plan Tax Deduction Really Worth

How Much Is Your State S 529 Plan Tax Deduction Really Worth

529 plans do not have annual contribution limits.

529 plan contribution limits. Annual 529 plan contribution limits. While 529 beneficiary transfers have few drawbacks 529 plan rollovers have important limits youll want to be aware of in order to avoid tax consequences. As a result most states have contribution limits of 300000 and up and most states will raise their limits each year to keep up with rising college costs.

The regulations would provide that rollovers from 529 plans together with any contributions made to the designated beneficiarys ABLE account other than certain permitted contributions of the designated beneficiarys compensation cannot exceed the annual ABLE contribution limit -- 15000 for 2018. How much can you contribute to a 529 plan in 2020. However there are limits defined for the aggregate contribution that varies from state to state.

State-Specific Contribution Limits. Below we cover the biggest pros and cons and 529 plan rollovers. Some states that sponsor 529 plans let you make tax-deductible contributions or receive tax.

This is based on the average expenses of five years of higher education at a private institution. Once you open an account youll pay a 013 annual asset-based fee or 130 in fees per year for each 1000 you contribute to the plan. 529 Plans and the Annual Gift.

The number jumps to 150000 for married couples. 529 Plan Contribution Limits. Georgia and Mississippi have the lowest maximum balance limits at 235000 followed by North Dakota at 269000.

Prepaid tuition plan or college savings plan. Individuals may contribute as much as 75000 to a 529 plan in 2020. 529 plan contribution limits are set by individual states and the states with the lowest limits Georgia and Mississippi allow contributions up to 235000 for each 529 plan.

Annual contribution limit for 529 plans. Savers can certainly place more than these amounts in a 529 plan. Annual gift tax exclusion.

For 529 contributions the IRS allows up to five years worth of contributions at once with the potential to avoid gift tax consequences. Some per-beneficiary contribution limits are listed below. Every states 529 plan allows for maximum contributions of at least 235000 per beneficiary.

Make a contribution to a Learning Quest college savings account through. Learning Quest has a high contribution limit of 435000 per beneficiary. The Coverdell ESA limits contributions to 2000 annually and restricts eligibility to those with adjusted gross income of 110000 or less if single filers and 220000 or less if filing jointly.

They range from 235000 to 529000. One of the many benefits of saving for a childs future college education with a 529 plan is. There are no fees and no minimum contribution amount necessary to open the plan.

A qualified K-12 withdrawal can be sent directly to a K-12 institution or to the participant. However contributions to a 529 plan are considered completed gifts for federal tax purposes and in 2019 up to 15000 per donor per beneficiary qualifies for the annual gift tax exclusion. And there are several convenient ways to contribute to your investment.

529 plan contribution limits are generally large. Once the combined 529 balances for a 529 plan reach the aggregate limit additional contributions can not be made. Savers going this route must fill out a Form 709 each year for five years to report the front-loaded contribution.

Tax Benefits by State. 529 plan will be treated as a non-qualified withdrawal and taxed as income to the extent previously deducted as a contribution to the Iowa 529 Plan. The maximum aggregate limit vary in the range of 235000in Georgia to 529000 for California.

State contribution limits range from around 200000 on the low end to more than. In 2020 many families are trying to make the most of their tax-advantaged. Some of the highest 529 plan contribution limits however can be found in Pennsylvania New York and California where they are 511758 520000 and 529000 respectively.

For the John Hancock Freedom 529 Plan theres a 1000 minimum for initial lump-sum contributions with subsequent contributions subject to a 50 minimum. The 529 plans dont have any limit for an annual contribution. Every states 529 plan allows for maximum contributions of at least 235000 per beneficiary.

Anyone can open and fund a 529 savings planthe student parents grandparents or other friends and relatives. An individual could contribute 75000 or 150000 for a married couple to a beneficiarys 529 in one lump sum but your IRS Form 709 must reflect your option to take the five-year election. 529 Plan Contribution Limits 529 Plan Contribution Limits by State.

Alternately you can open an account by setting up an automatic 50 per month payroll contribution. State-Specific Contribution Limits. A states limit will apply to either kind of 529 plan.