The goal of a PL report is to measure the profits by excluding the expenses from the income and provide an overview of the financial health of the business. One of the most important items of this pl is the sales line also called Revenue.

How To Read An Income Statement Dummies

How To Read An Income Statement Dummies

As opposed to the Balance Sheet this is measured over a certain booking period typically a year quarter or month.

P&l statement for dummies. The story of any company regardless of its size can be told through financial reports. The PL tells you if your company is profitable or not. This statement shows the revenues and expenses of the business and resulting profit or loss over a specific time period a month a quarter or a year.

Increasing sales or margins revenue and reducing costs or expenses. The profit and loss statement of a certain period. A PL is a financial statement or report that tells a narrative about your business over a specific period of time.

It is also known as the income statement or the statement of operations. Calculating the profitability of most food service establishments comes down to basic fundamental business components. Lets start with the PL ie.

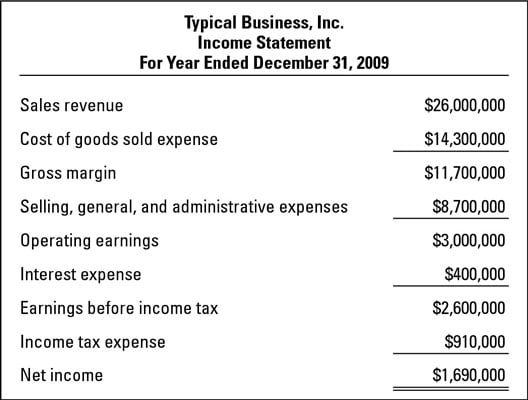

The profit and loss statement is the most interesting statement because it shows how you are doing as it relates to profit for a given period. The basic equation underlying the income statement is Revenue Expense Net Income. The figures posted to the profit and loss account may not be the same as the transactions in your bank account.

If you are looking at the June statement and it is December it really is not relevant. These reports are prepared as frequently as managers need them usually monthly or quarterly perhaps even weekly in some businesses. The balance sheet and the statement of cash flows.

What Is A Profit and Loss Statement. Costs are shown below sales and profit is at the bottom. What is Included in the Profit and Loss Statement.

A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a companys revenues expenses and profitslosses over a given period of time. The profit and loss PL report is a financial statement that summarizes the total income and total expenses of a business in a specific period of time. Profit performance reports prepared for a businesss managers typically are called PL profit and loss reports.

It is a snapshot of what revenues and costs are for the period you are looking at. Profit Loss Statements Reviewed to Know How to Read Understand the fundamentals of your PL Profit and Loss accounting and financial statements httpa. In other words your PL functions as a bank statement for your hospitality organization to monitor your companys financial health.

According to Investopedia a profit and loss statement is a financial statement that summarizes the revenues costs and expenses incurred during a specific period of time usually a fiscal quarter or year. The income statement is also known as a profit loss statement or a PL Revenue is also know as sales and is also called the top line. It starts with a summary of your revenue details your costs and expenses and then shows the all-important bottom lineyour net profit.

The profit and loss statement will show the business name and the period that the statement is for this can be a week month quarter year or any period that you require. Whatever name it goes by all it means is a record of your business profits and losses over a defined period of time. The most important financial statement any business needs is a profit and loss statement called a PL.

Accounting is full of jargon so youll also hear a profit and loss statement referred to as an income statement a profit and loss account or even a PL for short. Your income statement or profit and loss statement PL is the most popular and most common financial statement in any business plan. It is often said that the balance sheet is a static financial snapshot taken at the end of the year To read more see What is a Cash Flow Statement.

The PL statement shows a companys ability to generate sales manage expenses and create profits. What Is in a PL Statement The top line of the PL statement is revenue or the total amount of income from the sale of goods or services associated with the companys primary operations. A great tool for managing your restaurant is a profit and loss statement but solely depending on it to run your business is not ideal.

And Reading The Balance Sheet Statement of Cash Flows The statement of cash flows may be the most intuitive of all statements. Its the financial statement that bankers and investors will flip to first when reviewing your business plan. This financial statement is often used to analyze a companys financial position operations efficiency and performance in relation to competitors in its industry.

Sales are typically shown at the top of the PL. You may see a number of subtotals as you look down the column but it is still sales minus. A restaurant profit and loss statement also referred to as a restaurant PL shows your business costs and revenue net profit or loss during a specified period of time.

Sometimes its called an income statement. A profit and loss statement can go by many names such as a PL income statement earnings statement revenue statement operating statement statement of operations and statement of financial performance. The equation is simple but the terminology can be convoluted.

The language of business is numbers. The income statement often called a profit and loss statement provides an overview of a companys revenues expenses gains and losses over a given period.