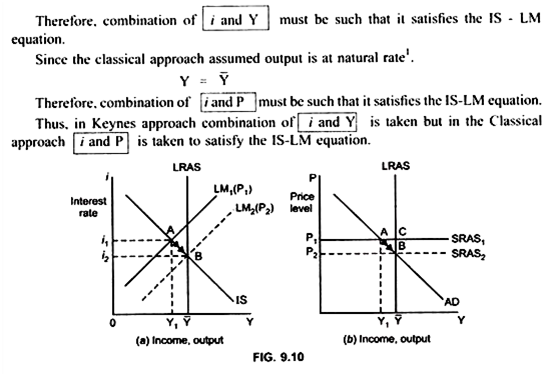

Heres how it goes. First the ISLM model explains changes in national income when price level is.

Derivation Of Is Lm Model In The Short Run And Long Run

Derivation Of Is Lm Model In The Short Run And Long Run

The intersection of the investmentsaving and liquidity preferencemoney supply curves models general equilibrium where supposed simultaneous equilibria occur in both the goods and the asset markets.

Is lm model for dummies. If Y is below this equilibrium level it will tend to rise. Hence mathematically we begin with the equation for a straight line. While not very accurate for real world analysis it gives an interesting look at possible outcomes of various policy tools for a classroom setting.

The IS-LM model lacks the precision and realism to be a useful prescription tool for economic policy. Whether its to pass that big test qualify for that big promotion or even master that cooking technique. Algebraic Analysis Joint Equilibrium of Income and Interest Rate The intersection of IS and LM curves determines joint equilibrium of income and interest rate.

Goods labour credit and money. Dummies has always stood for taking on complex concepts and making them easy to understand. This is because Keynes in his simple multiplier model popularly called Keynesian cross model assumes that investment is fixed and autonomous whereas IS-LM model takes into account the fall in private investment due to the rise in interest rate.

It basically shows the relationship between real output and interest rates. Dummies helps everyone be more knowledgeable and confident in applying what they know. Output for Rs lm Function showing the formula used the summary statistics for the residuals the coefficients or weights of the predictor variable and finally the performance measures including RMSE R-squared and the F-Statistic.

However even though from the theoretical point of view it has some loopholes it continues to be an excellent way of analyzing and understanding the behavior. The economy is made. In statisticalese we write Yˆ β 0 β 1X 91 Read the predicted value of the a variable Yˆequalsaconstantorintercept β 0 plus a weight or slope β 1.

Is-lm Model For Dummies The overshooting model or the exchange rate overshooting hypothesis first demand is determined by the standard open economy IS-LM mechanism. The LM stands for Liquidity and Money. Mathematically we can obtain the equilibrium values by using the equations of IS and LM curves derived above.

The IS LM model is a model used in macroeconomics to help explain the possible relationships between the interest rate and real GDP. The famous British economist John Hicks came up with it as a simple graphical representation of Keyness ideas in his General Theory. Depending on the interest rate which determines Ip there will be an equilibrium level of Y.

Yet two equivalent interpretations are possible. It has million of critiques and rightfully so. Simple Notes on the ISLM Model The Mundell-Fleming Model This is a model that describes the dynamics of economies in the short run.

The ISLM model or HicksHansen model is a two-dimensional macroeconomic tool that shows the relationship between interest rates and assets market. Understanding the IS-LM Model. This model is composed of a goods market and a money market.

Lecture 26 - The. People who rely on dummies rely on it to learn the critical skills and relevant information necessary for. They are meant to give you a more coincise and analytical presentation of the IS-LM model but many aspects of the model that are discussed in the book are not in these slides and we shall assume you have read.

Intro and the IS-LM Model 1402 Notes 1 March 3 2014 1These slides are NOT a substitute for chapters 2-5 of the book. Eral linear model GLM is linear That word of course implies a straight line. Hicks based on J.

Explaining ISLM curves - Macroeconomics Principles of Macroeconomics. The IS-LM Investment Savings-Liquidity preference Money supply model focuses on the equilibrium of the market for goods and services and the money market. The important ISLM model shows how the economy responds to fiscal and monetary policy in the very short run that is when prices are fixed.

The IS-LM model attempts to explain a way to keep the economy in balance through an equilibrium of money supply versus interest rates. The IS stands for Investment and Savings. 246 is less than EK which would occur in Keyness model.

Keynes General Theory in which he analysed four markets. IS LM Model. You can think of it as embodying two ideas.

The IS-LM model appears as a graph that shows the intersection of goods and the money market. The notion of equilibrium and how the macroeconomy is supposed to move toward it is the key to understanding the IS-LM model. Because of this it is important to remember the two formulas for IS and LM and that any change in the variables in the equations could cause a change in the graph.

It was developed by John R. It is worth noting that in the IS-LM model increase in national income by Y 1 Y 2 in Fig. It is possible for the IS curve Investment and Savings and the LM curve Liquidity preference and Money supply to either increase or decrease based on their determinants.

This post goes over the economics and intuition of the ISLM model and the possible causes for shifts in the two lines. On the vertical axis of the graph r represents the interest rate on government bonds.

The lipid bilayer gives fluidity and elasticity to the membrane. We are building a mosaic of colored 8les to depict the fluid mosaic model of the cell membrane.

Describe The Fluid Mosaic Model Of Cell Membrane

Describe The Fluid Mosaic Model Of Cell Membrane

The Fluid Mosaic Model states that membranes are composed of a Phospholipid Bilayer with various protein molecules floating around within it.

Fluid mosaic model of cell membrane. The concept of the fluid mosaic model and part of the plasma membrane. This model states that the components of a membrane such as proteins or glycolipids form a mobile mosaic in the fluid-like environment created by a sea of phospholipids. The fluid mosaic model describes the structure of the plasma membrane as a mosaic of components including phospholipids cholesterol proteins and carbohydratesthat gives the membrane a fluid character.

The current model that explains the structure of biological membranes is called the fluid mosaic model. The fluid mosaic model describes the cell membrane as a tapestry of several types of molecules phospholipids cholesterols and proteins that are constantly moving. And the structure of the plasma membrane supports the old saying Oil and water dont mix.

All cells are enclosed by a cell membrane. The extracellular environment is the area outside of the cell. A short video on the Fluid Mosaic Model of the cell membrane.

The model is consistent with the restrictions imposed by thermodynamics. The fluid mosaic model of the cell membrane is how scientists describe what the cell membrane looks and functions like because it is made up of a bunch of different molecules that are distributed across the membrane. According to this model the plasma membrane is similar to a fluid in which various molecules are arranged in a mosaic-like pattern.

The plasma membrane that surrounds these cells has two layers a bilayer of phospholipids fats with phosphorous attached which at body temperature are like vegetable oil fluid. A fluid mosaic model is presented for the gross organization and structure of the proteins and lipids of biological membranes. Consis8ng of the phospholipid bilayer proteins and filaments.

The fluid mosaic model describes the structure of the plasma membrane as a mosaic of components including phospholipids cholesterol proteins and carbohydratesthat gives the membrane a fluid character. The fluid mosaic model of the structure of cell membranes A fluid mosaic model is presented for the gross organization and structure of the proteins and lipids of biological membranes. The main biological membrane of a cell is the plasma membrane.

The model has evolved but it still accurately summarises the structure and functions of the plasma membrane. Each layer has two. The fluid mosaic model of cell membrane was first proposed by SJ.

The mosaic model of membrane structure describes the structure of the plasma membrane as a mosaic of components including phospholipids proteins carbohydrates cholesterol and proteins that gives the membrane a fluid character. Who Proposed Fluid Mosaic Model. Plasma membranes range from 5 to 10 nm in thickness.

The model has evolved somewhat over time but it still best accounts for the structure and functions of the plasma membrane as we now understand them. Singer and Garth L. The fluid mosaic model is one way of understanding biological membranes consistent with most experimental observations.

The fluid mosaic model of plasma membrane is the most accepted hypothesis which describes the membranous components and their functions. The fluid-mosaic model describes the plasma membrane of animal cells. Small amounts of carbohydrates are also found in the cell membrane.

The fluid mosaic model explains various observations regarding the structure of functional cell membranes. The model is consistent with the restrictions imposed by. The Fluid Mosaic Model states that membranes are composed of two layers of phospholipids molecules.

The biological model which was devised by SJ Singer and G. The Fluid Mosaic Model was first proposed in 1972 to explain the structure of the plasma membrane. A short video on the Fluid Mosaic Model of the cell membrane.

The Fluid part represents how some parts of the membrane can move around freely if they are not attached to other parts of the cell. Cut out the oval and paste it into your notebook. Nicolson in 1972 describes the cell membrane as a two-dimensional liquid that restricts the la.

The protoplasm of every living cell is enclosed by a plasma membrane. The concept of the fluid mosaic model and part of the plasma membrane. This movement helps the cell membrane maintain its role as a barrier between the inside and outside of the cell environments.

According to this biological model there is a lipid bilayer in which protein molecules are embedded. This structure has two layers and is represented in the diagram below. 2014 Vanessa Jason Biology Roots the cell membrane- Fluid Mosaic Model Student Directions- The oval at le is the cell membrane.

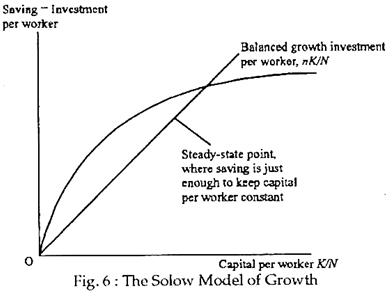

There are no prices because we are strictly interested in output real income. Solow made his model an alternative to Harrod-Domar model of growth.

Solow Model Of Economic Growth Economics

Solow Model Of Economic Growth Economics

A constant savings-investment share of production s and capital deprecation rate δ.

Solow growth model for dummies. The Solow Growth Model The Solow Growth Model is a model of capital accumulation in a pure production economy. Bob Solow has carried out some of the most important work in macroeconomics by creating the Solow model of economic growth. The Solow Growth Model can be termed as an exogenous economic growth model which is used to analyse the change in the economic output over the time in the saving rate population growth rate and technological progress.

The role of technology as a labour augmenting factor in Solows model is presented belowY K αAL 1-αA is exogenous technological knowledge improving productivity of labourBecause technological change is assumed to be outside the economy the Solow growth model exhibits constant returns to scale and diminishing marginal returns to capitalIn Solows model savings population growth and technological progress affect growth but they are all exogenous. The Solow growth model also called the neoclassical growth model was developed by Robert Solow and Trevor Swan in 1956. The more that people in an economy save of their income the greater the amount of investment.

Solow growth model is a neoclassical model of growth theory developed by MIT economist Robert Solow. The Solow Growth Model is an exogenous model of economic growth that analyzes changes in the level of output in an economy over time as a result of changes in the population growth rate the savings rate and the rate of technological progress. Develop a simple framework for the proximate causes and the mechanics of economic growth and cross-country income dierences.

Solow groth model 2 1. The Solow-Swan model of economic growth postulates a continuous production function linking output to the inputs of capital and labour which leads to the steady state equilibrium of the economy. The Solow growth model is designed to show how growth in the capital stock growth in the labor force and advances in technology interact in an economy as well as how they affect a nations total output of goods and services.

Efficient steady-state per capita capital stock will appear steady state. And a constant elasticity θ of production Y with respect to the economys capital intensity κ where capital intensity is defined as κ KY the quotient. Robert Solow later received the Nobel Prize in Economics in 1987 for his work on this theory.

Solow growth model is a model that explains the relationship between economic growth and capital accumulation and concludes that economies gravitate towards a steady state of capital and output in the long-run. It implies that it is possible for economies to grow in the short run by increasing. It ensures steady growth in the long run period without any pitfalls.

Builds on the production model by adding a theory of capital accumulation Was developed in the mid -1950s by Robert Solow of MIT Was the basis for the Nobel Prize he received in 1987 Additions differences with the model Capital stock is no longer exogenous Capital stock is now endogenised. His benchmark model is still taught in universities throughout the world. Everyone works all the time so there is no laborleisure choice.

The Solow Growth Model TheSolow Growth Modelis a model ofcapital accumulationin a pure production economy. SOLOW GROWTH MODEL CHAPTER 4. The SolowSwan model is an economic model of long-run economic growth set within the framework of neoclassical economics.

Solow Solow growth of the neoclassical economic theory suggests that economic growth per capita by an efficient capital stock capital stock per effective worker growth of production. The Solow Model is an economic growth model that indicates the changes in economic growth brought about by changes in other economic factors like population growth savings. The Solow Growth Model was created by the economist Robert Merton Solow.

How does an economy well-approximated by the Solow growth modelone that has a constant labor-force growth rate n and labor-efficiency growth rate g. Here is a summary of its key lessons. Everyone works all the time so there is no laborleisure choice.

Solow growth model In 1956 𝑠𝑜𝑙𝑜𝑤 introduce his model of economic growth Solow recognize the problem of rigid production function in harrod-domar model Solow dropped the fixed coefficient production function and replaced it by a neoclassical production function that allows for more flexibility and. There are no prices because we are strictly interested in output real income. Solow-Swan model named after Robert Bob Solow and Trevor Swan or simply the Solow model.

The Solow growth model is an extension of the Harrod-Domar Model. It attempts to explain long-run economic growth by looking at capital accumulation labor or population growth and increases in productivity commonly referred to as technological progress.