As we can see here that while the revenue share is largest for Product B it is Product C which has highest Unit Contribution margin. How to calculate the contribution margin contribution ratio unit.

Contribution Margin Meaning Formula How To Calculate

Contribution Margin Meaning Formula How To Calculate

Openstax CC BY-NC-SA 40.

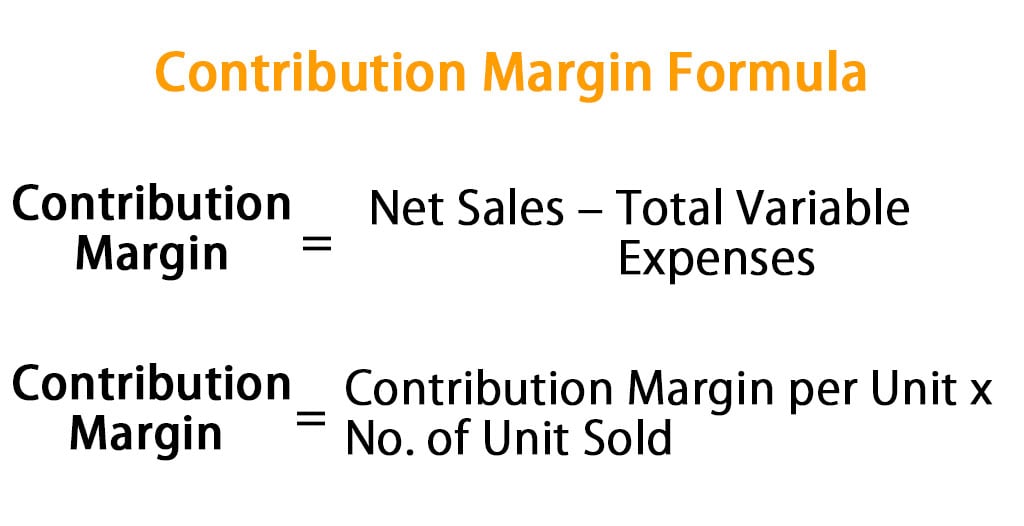

How to calculate unit contribution margin. You calculate it by subtracting variable costs per unit from sales price per unit as in this formula. To calculate your per-unit contribution margin divide the total margin by the number of units produced. Calculating the unit contribution margin uses the total revenues minus the variable costs divided by the total number of units.

The amount of variable expense to use in the calculation varies considerably depending on the situation. Unit Contribution Margin Selling Price per Unit Variable Cost per Unit Alternately the formula for UCM can be expressed as the difference of sales and total variable cost divided by the number of units sold. A single products contribution margin is given with the formula P - V where P is the cost of the product and V is its variable cost the costs associate with resources used to make that item specifically.

You can use the contribution margin calculator using either actual units sold or the projected units to be sold. However if there are many. You can find the contribution margin per unit using the equation shown in Figure 74.

A contribution format income statement lists the revenue and variable costs and presents the contribution margin. The contribution margin per unit represents the incremental money generated for each productunit sold after deducting the variable portion of the firms costs is calculated using Contribution Margin per UnitSales Price per Unit-Variable Cost per Unit. Of units of C sold 66750250 267.

Total revenues - Total variable costs Total units Contribution per unit. Consider the following examples of how this margin can be used. Online Calculators Financial Calculators Contribution Margin Calculator Contribution Margin Calculator.

With our tool you need to enter the respective value for Variable Cost per Unit and Sales Price per Unit and hit the calculate button. Mathematically it is represented as Unit Contribution Margin Sales Total Variable Cost No. When only one product is being sold the concept can also be used to estimate the number of units that must be sold so that a business as a whole can break even.

Thus the calculation of contribution per unit is. Contribution margin per unit Sales price per unit Variable costs per unit. The contribution margin equals total revenue minus all variable expenses.

The Contribution Margin Per Unit Calculator calculates the contribution margin per unit and contribution margin ratio. Thus it will help you to evaluate your past performance and forecast your future profitability. Contribution margin of the product as well as the break-even point and the determined profit.

When the contribution margin is calculated on a per unit basis it is referred to as the contribution margin per unit or unit contribution margin. Calculating Unit Contribution Margin To calculate the formula for. Unit-specific revenue - unit-specific variable costs Unit-specific revenue Unit contribution margin.

In the example dividing the margin of 170000 by the 105000 shirts you produced gives you a unit margin of 162 per shirt. Contribution Margin Calculator - calculate contribution margin which is the differences between a companys net sales and variable costs. For example if a business has 10000 of fixed costs and each unit sold generates a contribution margin of 5 the company must sell 2000 units in order to break even.

To calculate Headphones Todays contribution margin ratio we use the contribution margin per set of headphones and divide it by the price per set of headphones which is 15 40 375. To calculate Contribution Margin per Unit you need Variable Cost per Unit V and Sales Price per Unit SP. The Contribution Margin Calculator is an online tool that allows you to calculate contribution margin.

It represents the money available to pay fixed expenses and increase the profits of the business. Contribution margin per unit measures how the sale of one additional unit would affect net income. In effect it is product C which has the most profitability.

Contribution margin revenue variable costs For example if the price of your product is 20 and the unit variable cost is 4 then the unit contribution margin is. Its a simple calculation. Contribution margin is a concept often used in managerial accounting to analyze the profitability of products.

Contribution Margin of C 23850 no. Unit contribution margin unit selling price unit variable cost. It is important to note that this unit.

How to calculate contribution Margin from Balance Sheet. Contribution Margin For More video link given below of Playlist link Balance Sheet. You can express contribution margin or unit contribution margin as a ratio by dividing contribution margin by selling price.

The formula for unit contribution margin is.

How to calculate contribution Margin from Balance Sheet. The contribution margin sometimes used as a ratio is the difference between a companys total sales revenue and variable costs.

7 1 Exploring Contribution Margin Financial And Managerial Accounting

7 1 Exploring Contribution Margin Financial And Managerial Accounting

Contribution margin revenue variable costs For example if the price of your product is 20 and the unit variable cost is 4 then the unit contribution margin is.

How to find contribution margin. An important point to be noted here is that fixed costs are not considered while evaluating the contribution margin per unit. The actual calculation of contribution margin may be more laborious but the concept applies. Net the gross sales amount against any deductions such as for sales allowances to arrive at the net revenue figure.

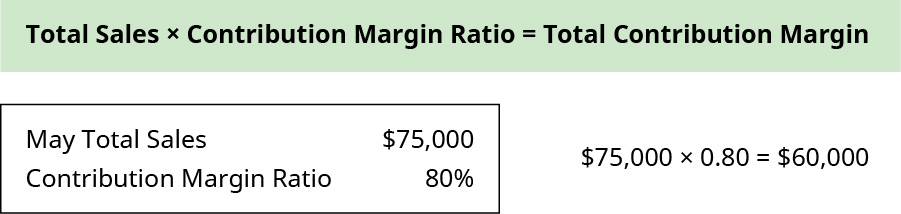

The contribution margin ratio can help companies calculate and set targets for the profit potential of a given product. The formula for contribution margin is simple and just involves a little subtraction. The 600000 is the amount left over to pay fixed costs.

You need to work out the contribution margin per unit the increase in profit if there is a one unit increase in sales. Work out contribution. This left-over value then contributes to paying the periodic fixed costs of the business with any remaining balance contributing profit to the owners.

The contribution margin per unit is calculated as. Contribution margin per unit measures how the sale of one additional unit would. Examples of these costs.

We can use the contribution margin formula to find out what this means for their bottom line. Thus the calculation of contribution per unit is. In other words the contribution margin equals the amount that sales exceed variable costs.

This is the sales amount that can be used to or contributed to pay off fixed costs. For example say you produced 105000 shirts. How to Compute Contribution Margin Figure total contribution margin.

To calculate the contribution per unit summarize all revenue for the product in question and subtract all variable expenses from these revenues to arrive at the total contribution margin and then divide by the number of units produced or sold to arrive at the contribution per unit. Total contribution margin measures the amount of contribution margin earned by the. Calculate contribution margin per unit.

Contribution margin is the amount left-over after deducting from the revenue the direct and indirect variable costs incurred in earning that revenue. Contribution margin is equal to sales revenue less total variable expenses incurred to earn that revenue. Use the following formula to calculate the contribution margin ratio.

The contribution margin for this example would be the difference of 1000000 and 400000 which is 600000. This is the total amount you received from selling the product. Total variable expenses include both manufacturing and non-manufacturing variable expenses.

The steps to follow to calculate contribution margin for a specific sale transaction are as follows. To calculate the total contribution margin start with the sales revenue generated by a product. Aggregate all variable costs associated with the sale.

Also it is important to calculate the contribution margin to know the price at which you need to sell your goods and services to earn profits. The difference between sales price 200 and variable cost per unit 130. The contribution margin is the difference between sales and variable costs.

Its a simple calculation. The contribution margin for Tennis shoes is easiest to calculate. In the Dobson Books Company example the contribution margin for selling 200000 worth of books was 120000.

How to Calculate Contribution Margin Contribution Margin Formula. 20 10 10 It simply means that by selling this cupcake the net income or profit increases by 10. In a service firm contribution margin is equal to revenue from provision of services less all variable expenses incurred to provide such services.

So if the price of your product is 25 and the unit variable cost is 5 the units contribution margin is 20. Hence the contribution margin per additional unit of the cupcake will be. The result is the margin.

It equals 70 ie. Contribution Margin For More video link given below of Playlist link Balance Sheet. From that amount subtract the total variable costs in the production run.

The amount thats left over is the combination of fixed expenses and profit. Contribution margin ratio contribution margin sales where contribution margin sales minus variable costs. A per product margin can be found by dividing 600000 by the number of units sold.

Generally speaking you want your contribution margin to be as high as possible. This was calculated using the following formula. 50000 20000 30000 While the contribution margin is 30000 the businesss fixed costs premises staffing insurance etc mean that the company is making a net loss of 10000.

Who can receive a distribution for K-12 tuition. For a prepaid tuition plan the states limit is a limit on the total contributions.

How Much Is Your State S 529 Plan Tax Deduction Really Worth

How Much Is Your State S 529 Plan Tax Deduction Really Worth

529 plans do not have annual contribution limits.

529 plan contribution limits. Annual 529 plan contribution limits. While 529 beneficiary transfers have few drawbacks 529 plan rollovers have important limits youll want to be aware of in order to avoid tax consequences. As a result most states have contribution limits of 300000 and up and most states will raise their limits each year to keep up with rising college costs.

The regulations would provide that rollovers from 529 plans together with any contributions made to the designated beneficiarys ABLE account other than certain permitted contributions of the designated beneficiarys compensation cannot exceed the annual ABLE contribution limit -- 15000 for 2018. How much can you contribute to a 529 plan in 2020. However there are limits defined for the aggregate contribution that varies from state to state.

State-Specific Contribution Limits. Below we cover the biggest pros and cons and 529 plan rollovers. Some states that sponsor 529 plans let you make tax-deductible contributions or receive tax.

This is based on the average expenses of five years of higher education at a private institution. Once you open an account youll pay a 013 annual asset-based fee or 130 in fees per year for each 1000 you contribute to the plan. 529 Plans and the Annual Gift.

The number jumps to 150000 for married couples. 529 Plan Contribution Limits. Georgia and Mississippi have the lowest maximum balance limits at 235000 followed by North Dakota at 269000.

Prepaid tuition plan or college savings plan. Individuals may contribute as much as 75000 to a 529 plan in 2020. 529 plan contribution limits are set by individual states and the states with the lowest limits Georgia and Mississippi allow contributions up to 235000 for each 529 plan.

Annual contribution limit for 529 plans. Savers can certainly place more than these amounts in a 529 plan. Annual gift tax exclusion.

For 529 contributions the IRS allows up to five years worth of contributions at once with the potential to avoid gift tax consequences. Some per-beneficiary contribution limits are listed below. Every states 529 plan allows for maximum contributions of at least 235000 per beneficiary.

Make a contribution to a Learning Quest college savings account through. Learning Quest has a high contribution limit of 435000 per beneficiary. The Coverdell ESA limits contributions to 2000 annually and restricts eligibility to those with adjusted gross income of 110000 or less if single filers and 220000 or less if filing jointly.

They range from 235000 to 529000. One of the many benefits of saving for a childs future college education with a 529 plan is. There are no fees and no minimum contribution amount necessary to open the plan.

A qualified K-12 withdrawal can be sent directly to a K-12 institution or to the participant. However contributions to a 529 plan are considered completed gifts for federal tax purposes and in 2019 up to 15000 per donor per beneficiary qualifies for the annual gift tax exclusion. And there are several convenient ways to contribute to your investment.

529 plan contribution limits are generally large. Once the combined 529 balances for a 529 plan reach the aggregate limit additional contributions can not be made. Savers going this route must fill out a Form 709 each year for five years to report the front-loaded contribution.

Tax Benefits by State. 529 plan will be treated as a non-qualified withdrawal and taxed as income to the extent previously deducted as a contribution to the Iowa 529 Plan. The maximum aggregate limit vary in the range of 235000in Georgia to 529000 for California.

State contribution limits range from around 200000 on the low end to more than. In 2020 many families are trying to make the most of their tax-advantaged. Some of the highest 529 plan contribution limits however can be found in Pennsylvania New York and California where they are 511758 520000 and 529000 respectively.

For the John Hancock Freedom 529 Plan theres a 1000 minimum for initial lump-sum contributions with subsequent contributions subject to a 50 minimum. The 529 plans dont have any limit for an annual contribution. Every states 529 plan allows for maximum contributions of at least 235000 per beneficiary.

Anyone can open and fund a 529 savings planthe student parents grandparents or other friends and relatives. An individual could contribute 75000 or 150000 for a married couple to a beneficiarys 529 in one lump sum but your IRS Form 709 must reflect your option to take the five-year election. 529 Plan Contribution Limits 529 Plan Contribution Limits by State.

Alternately you can open an account by setting up an automatic 50 per month payroll contribution. State-Specific Contribution Limits. A states limit will apply to either kind of 529 plan.