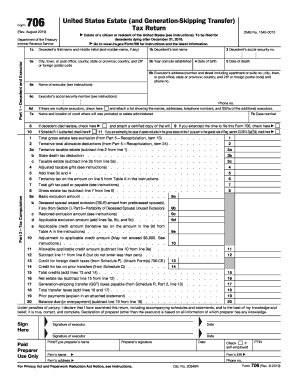

The executor takes terminable interest property that doesnt qualify for the marital deduction and turns it into QTIP. Tax Computation 1 2 3.

Et 90 4 Department Of Taxation And Finance New York State

Et 90 4 Department Of Taxation And Finance New York State

How to Complete Schedule M for Estate Form 706 By Margaret Atkins Munro Kathryn A.

Form 706 schedule m. If you extended the time to file this Form 706 check here 10. Form 706 Schedule R-1 Generating-Skipping Transfer Tax 0919 10012019 Form 706-A. Preparing a Federal Estate Tax Return.

Murphy If your decedent left a surviving spouse you may have a whopper of a deduction available to you which you report on Schedule M. Information about Form 706 United States Estate and Generation-Skipping Transfer Tax Return including recent updates related forms and instructions on how to file. Alternate value Value at date of death.

Form 706 Schedule O Charitable Public and Similar Gifts and Bequests Static RESOURCE R517. Form 706 is due nine months after DOD but the filing deadline can be extended an additional six months with Form 4768. United States Additional Estate Tax Return 0819 08232019 Inst 706-A.

The total value of the property valued under section 2032A may not be decreased from FMV by more than 1180000 for decedents dying in 2020. This form is a complicated return to prepare running more than 25 pages with more than 15 schedules. Part 2Tax Computation 1.

See Generating Form 706 Schedule E Part 1 andor Part 2 for more information. The tax liability must generally be paid nine months after DOD. ABC in the same field for that asset.

Schedule MBequests etc to surviving spouse see instructions or Oregon Schedule OR-OSMP. Office use only Page 1 of 3 150-104-001 Rev. Learn How to Prepare the Federal Estate Tax Return Form 706 This convenient and timely two-hour CPE webinar addresses the preparation of IRS Form 706 the US.

Certification of Payment of Foreign Death Tax. The election can also be made on an amended Form 706 filed before the extended due date for filing the original estate tax return. Form 706 is required to be filed.

Form 706 Schedule M Bequests etc. 02200304170094 ET-706 417 Page 3 of 6 List below each item of real and tangible personal property located within New York StateInclude the item number the schedule of federal Form 706 or Form 706-NA on which it was reported and the reported value of the property. Form 706 is used to figure the estate tax imposed by Chapter 11 and compute the GST tax imposed by Chapter 13 on direct skips.

Deductions and residue carry to the QTIP section of Schedule M. If Schedule R-1 is attached check here 11. It is a good practice to include all of the schedules and mark 0 on those schedules that do not show any assets exclusions or deductions.

Schedule MBequests etc to surviving spouse see instructions or Oregon Schedule OR-OSMP. You may make the election on a late-filed return so long as it is the first return filed. Interest in the qualified terminal interest property by listing the property on Schedule M of Form 706.

Form 706 with a revision date of July 1999 which must be completed and submitted with this return whether or not a current federal estate tax return US. This tax is levied on the entire taxable estate not just on the share received by a particular beneficiary. The executor of a decedents estate uses Form 706 to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code.

Excerpts from teaching class NBI 2008. Office use only Page 1 of 3 150-104-001 Rev. Form 706 is also used to compute the generation-skipping transfer GST tax imposed by Chapter 13 on direct skips.

2019 Form OR-706 Oregon Estate Transfer Tax Return Submit original formdo not submit photocopy. Continuation Schedule Static RESOURCE R601. There are 5 parts in the Form 706 9 schedules to determine the gross estate and 7 schedules for deductions.

You must file Schedule A-1 and its required attachments with Form 706 for this election to be valid. Instructions for Form 706-A United States Additional Estate Tax Return 0819 08232019 Form 706-CE. The total is included in the amount on Form 706 Part 4 line 4c.

The personal representative of the estate may apply to be released from personal liability for the estate gift and income taxes of the decedent. If you are estimating the value of assets included in the gross estate on line 1 pursuant to the special rule of Reg. Form 709 Schedule A Part 1 Gifts Subject Only to Gift Tax Static.

PreparingaFederalEstateTaxReturnForm706By Yahne Miorini LLM. Schedule references are to the schedules of the US. You are able to type up to 3 letters of co-tenant ex.

If a return was not filed timely the election can be made on the first return filed after the due date. For more than 3 co-tenants youd need to split the asset and then re-assign next co. Section 202010-2a7ii check here.

How can I input two or more letters of co-tenant for a property in Schedule E. The name QTIP stands for qualified terminable interest property. A Preparers Mistake Consider a husband and wife with a combined estate of 5 million and an estate plan with a will containing trust provisions for both tax and family purposes.

To a Surviving Spouse Static RESOURCE R516. If decedent died testate check here 9If you extended the time to file this Form 706 check here If Schedule R-1 is attached check here Part 2. 2020 Form OR-706 Oregon Estate Transfer Tax Return Submit original formdo not submit photocopy.

Federal Estate Tax Return. Preparers using Form 706 must be familiar with the requirements of reporting on Schedule M for the appropriate marital deduction.