The first type of numbering to determine for a chart of accounts involves their structure. 1 2 Every account in the general ledger chart of accounts is assigned a specific code and this is what we call a chart of accounts numbering.

Sample Chart Of Accounts For A Small Company Accountingcoach

Sample Chart Of Accounts For A Small Company Accountingcoach

You can assign account numbers yourself in one of two ways.

Chart of accounts numbering. The most common number system is. Each account in the chart of accounts is typically assigned a name and a unique number by which it can be identified. The numbering system used is critical to the ways in which financial information is stored and manipulated.

Division code - This is typically a two-digit. Typically a chart of accounts will have four categories. Let QuickBooks assign a numbering system for you.

It is basically a listing of all the accounts found in the general ledger that the business will use to code each bookkeeping transaction. The chart of accounts often abbreviated to COA is the foundation of the double entry bookkeeping system. How to Make a Chart of Accounts Size.

The chart of accounts is a list of the account numbers and names relevant to your company. Chart of accounts numbering involves setting up the structure of the accounts to be used as well as assigning specific codes to the different general ledger accounts. For example by adding the relevant division code to the production department wages expense code 01-620 referred to above a separate account is created which will identify the production department wage expense for that specific division.

Each account should have a number to identify it. Secondly it is essential to carry out with the numbering as it can help us pick any account based on its. Sales and Cost of Goods Sold accounts.

What is the purpose of a chart of accounts. The chart is used by the accounting software to aggregate information into an entitys financial statements. The chart of accounts is a listing of all accounts used in the general ledger of an organization.

The chart of accounts is an organized list of accounts or buckets in which to record accounting transactions. This is the layout of an account number and involves the following components. Software for some small businesses may not require account numbers Account numbers are often five or more digits in length with each digit representing a division of the company the department the type of account etc.

The chart of accounts is a list of every account in the general ledger of an accounting system. Furthermore the company chart of accounts is basically a filing system for categorizing all of a companys accounts as well as classifying all transactions according to the accounts they affect. The purpose is to organize the accounts and group similar ones together.

The chart of accounts structure determines the level of detail available for financial reporting. Unlike a trial balance that only lists accounts that are active or have balances at the end of the period the chart lists all of the accounts in the system. Software for some small businesses such as QuickBooks may not require account numbers.

Small businesses commonly use three-digit numbers while large businesses use four-digit numbers to allow room for additional numbers as the business grows. To set up a chart of accounts one first needs to define the various accounts to be used by the business. Standard Chart of Accounts In accounting a standard chart of accounts is a numbered list of the accounts that comprise a companys general ledger.

Now you can spend less time looking for specific accounts in Chart of Accounts or when adding transactions. The four primary groups in a standard chart of accounts are. The general format of the 7 digit chart of accounts numbering system is therefore XX-XX-XXX where the first two digits are the division code and as before the next two digits are the department code and the final three digits are the account code.

To see your accounts numbers go to the Chart of Accounts. This sample chart of accounts provides an example using some of the most commonly found account names. It can be added to or changed to suit the business needs.

Firstly identify the structure of your business whether it is a sole trading business partnership or a. Its a simple list of account numbers and names. A Chart of Accounts lists all the accounts in the general ledger.

Quickly find accounts using the numbers you assigned to them. The chart of accounts is a list with all the names of the accounts that a company has available to use. Each account in the chart of accounts is typically assigned a name and a unique number by which it can be identified.

The chart of accounts is a listing of all the accounts in the general ledger each account accompanied by a reference number. This helps the account managers to locate accounts while making entries and preparing financial statements easily. To see a working example of the entire hierarchy click the button to download the chart of accounts template that we actually use as a starting point on our engagements.

Most accounting software has a set chart of accounts CoA when it is setup. The chart is usually sorted in order by account number to ease the task of locating specific accounts. Example of numbering system for the chart of accounts.

An example of this is manufacturing may need different codes to a retail business. Typically when listing accounts in the chart of accounts you should use a numbering system for easy identification. The chart of accounts is therefore the foundation of the financial statements.

Select the Gear icon at the top of the list not on the navigation bar in the Action column. Numbering also makes it easy to record a transaction. Numbering Your Chart of Accounts QuickBooks doesnt assign numbers to your accounts when you set them up through the EasyStep interview.

Learn more about accountants and bookkeepers in our Accounting Career Center We will begin with two T-accounts. This T accounts template will enable you to quickly produce your own accounting entries to see the impact they have on your business before posting.

Accounting Ledger Accounting For Dummies Accounting Student Accounting Classes Bookkeeping Business

Accounting Ledger Accounting For Dummies Accounting Student Accounting Classes Bookkeeping Business

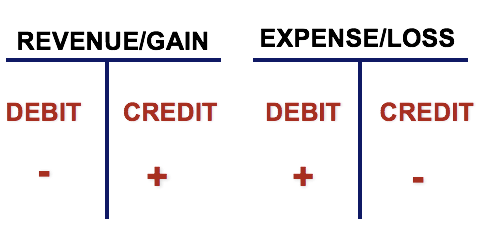

For example on a T-chart debits are listed to the left of the vertical line while credits are listed on the right side of the vertical line making the companys general ledger easier to read.

T accounts for dummies. Dummies has always stood for taking on complex concepts and making them easy to understand. The T Account is a visual representation of individual accounts template helps you organize and balance the debits and credits for your transactions and journal entries Journal Entries Guide Journal Entries are the building blocks of accounting from reporting to. These are books in the public domain which means that they.

This t-account T Accounts Guide If you want a career in accounting T Accounts may be your new best friend. Cash and Notes Payable. Whether its to pass that big test qualify for that big promotion or even master that cooking technique.

Heres What Well Cover. MOBI Keeping Tips T Accounts Accounting For Dummies keeping Tips T Accounts Authorama offers up a good selection of high-quality free books that you can read right in your browser or print out for later. Each T account shows the name of the account at the top eg Expenses and is split into two sides.

The T Account is a visual representation of individual accounts in the form of a T making it so that all additions and subtractions debits and credits to the account can be easily tracked and represented visually. This is a good start bookkeeping tips t accounts accounting for dummies epub It looks and sounds great for many peoples clue Understanding Different Types of Health Savings Accounts HSA health savings account tax tips best health accounts 3 Tax Reasons to Contribute to a Health Savings Account SmartAsset How To Use. An account has the following format.

This template allows you to take on the second step of the accounting cycle without a lot of hassle or difficulty after making your journal entries in the general journal. The simplest account structure is shaped like the letter T. The T account is a fundamental training tool in double entry accounting showing how one side of an accounting transaction is reflected in.

The T-Account Ledger Template for Excel helps you create an organized and professional looking t-account ledger whether for your business organization or personal use. Developing A Financial Statement Worksheet For Your Business. Accountants and bookkeepers often use T-accounts as a visual aid to see the effect of a transaction or journal entry on the two or more accounts involved.

Further details on the use of T accounts can be found in our tutorial on Basic T accounting. It depicts credits graphically on the right side and debits on the left side. T Accounts For Dummies Understanding Accounts Basic Finance For Non Financial Managers.

The visual presentation of journal entries which are recorded in the general ledger account is known as the T-Account. The easiest way to show how to do T accounts is by looking at an example. As you can see the conventional account has the format of the letter T.

The name of the account is written above the T along with the account number if available while the total balance for each T account is written at the. Debits abbreviated Dr always go on the left side of the T and credits abbreviated Cr always go on the right. It is called the T-account because entries of bookkeeping are shown in a way that resembles the shape of alphabet T.

Connecting The Income Statement And Balance Sheet Accounting. The grand total balance for each T account appears at the bottom of the account. Also an account may have a running balance column to continuously keep track of the accounts balance.

In other words an account has a debit column and a credit column. A number of T accounts are typically clustered together to show all of the accounts affected by an accounting transaction. This T-Account Ledger Template for Excel features.

Dummies helps everyone be more knowledgeable and confident in applying what they know. Accounts personnel may even produce a debtors or creditors reconciliation statement which is a report showing the discrepancies between the control account general ledger and the total of the individual T-accounts in the debtors or creditors ledger. Using A Sales Journal To Record Non Cash Transactions General Ledger.

Each account will have its own individual T Account which looks like the following. A T Account is the visual structure used in double entry bookkeeping to keep debits and credits separated. The PDF file available for download below will help you to produce your own T Account Templates.

T Account is a visual presentation of accounting journal entries that are recorded by the company in its general ledger account in such a way that it resembles to shape of alphabet T and depicts graphically credit balances on right side of the account and debit balances on the left side of the account. The account title and account number appear above the T. By account we mean a summary record of all transactions relating to a particular item in a business.

Tips T Accounts Accounting For Dummies T Accounts in Bookkeeping Double Entry Bookkeeping The accounts have the format of letter T and are thus referred to as the T accounts. Each example of the T-account states the topic the relevant reasons and additional comments as needed. People who rely on dummies rely on it to learn the.

In the T- Accounts the debit side always lies at the left side of the T outline and the credit side always lies at the right side of the T outline. Suppose a business made a cash payment for expenses then the T accounting would look like this. Hence they are often referred to as T accounts.

Although the actual accounts maintained by a business dont necessarily look like T accounts accounts usually have one column for increases and another column for decreases. In accounting we open an account for each item in our records.

In this video we have tr. All these things appear on the balance sheet and that to all those comes under the current liabilities.

Accounts Payable Explanation Journal Entries Examples Accounting For Management

Accounts Payable Explanation Journal Entries Examples Accounting For Management

It is important to learn that how we need to record our credit purchase and the factors which are coming to close the purchase deal.

Journal entries for accounts payable. In this case the company has an obligation to pay to suppliers based on the credit term which is usually shown on supplier invoice. At the time of recording an invoice. In each case the accounts payable journal entries show the debit and credit account together with a brief narrative.

What Is the Journal Entry for Accounts Receivable. It was found that out of the purchases damaged goods were received worth 10000 so it was returned to the. For this the freight.

Support Staff 240408-5320 CPP Expense 10614-5330 WCB Expense 5588-5400 Medical Premium Expense 2200-1080 Bank. If a part or whole of the. When damaged or otherwise undesirable inventory is returned to the supplier.

The journal entries to recognize account payable is not different from recording the other liabilities in the financial statements. When merchandise inventory is purchased on account. The accounts payable method which is what Journal Entries 5 and 6 show is the best way to record your bills.

For a fuller explanation of journal entries view our examples section. In accounts payable or AP it is like an accounting entry which can represent the companys obligation to pay the short-term debt to its creditors or even suppliers. Journal entries for Accounts Payable.

Page 4 Helenas Academy Payroll Journal 10012020 to 12312020 Account Number Account Description Debits Credits 2430 Medical Payable - Employee-4400 2440 Medical Payable - Employer-4400 2460 WCB Payable-1992 11152020 J39 DD61 Handie Jerome 5260 Wages. As you may have already figured out the accounts payable method is really the mirror image of the accounts receivable approach. The accounts payable journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of accounts payable.

Adjusting journal entries and accounts payable. Typical Accounts Payable Journal Entries. Here we have explained accounts payable accounting journal entries with an example.

You could set up an accrued payable account to record this entry or as you say since you are 99 or more sure that this is for the accounting fees just set up a payable invoice using a reference like2013 YE 08 to the accountant at year end and a credit note as of the first of the new fiscal year. Accounts payable in General Journal Journal entries should be the exception when using QB they often do not work as you think they should and they never work for inventory when you use inventory type items. Here in this example the inventory account will be debited and accounts payable will be credited.

Journal Entries Related to Accounts Payable Below are two main scenarios linked to the accounts payable cycle where in the first case the credit purchase is recorded and in the second case the cash paid to the supplier is recorded in the books of accounts. Accounts Payable Journal Entries refers to the amount payable accounting entries to the creditors of the company for the purchase of goods or services and are reported under the head current liabilities on the balance sheet and this account debited whenever any payment is been made. On March 31 2020 ABC company purchased 1000 worth of inventory items on credit from the CDE company.

Accounts Payable creates entries for General Ledger when you revalue an invoice in a source non-functional currency at an exchange rate that is different from the rate currently used by the invoice. The typical journal entries related to accounts payable are given below. When a sale of goods or services is made to a customer you use your accounting software to create an invoice that automatically creates a journal entry to credit the sales account and debit the accounts receivable account.

The entry is Accounts Payable credit and Rent Expense Debit. In notes payable accounting there are a number of journal entries needed to record the note payable itself accrued interest and finally the repayment. The following transaction registers a loss because changes in the exchange rate have increased the value of the vendor invoice.

The accountant provided adjusting journal entries and one is for rent expense that was booked in current fiscal year but he made an adjustment to book it in previous year end. Journal entry to record the sales invoice-. This is because the period that an entity will settle to the supplier is less than 12 months.

If merchandise inventory is purchased on account the accounts. It is much better to use the forms on the home page the way QB is designed to be used. Company purchased the inventory worth 50000 with terms 210 n30 FOB shipping point.

Accounts Payable Journal Entries Example 2 Feb 02. The accounts payable are the current liabilities that are shown on the balance sheet for which the balances are due within one year. Account payable is recording as a current liability in the entity balance sheet.

The accounts payable method means that you record expenses when the expenses actually occur.

If there is a Jrnl Type other than AR this would indicate that an entry was made to the Accounts Receivable account through a module other than Accounts Receivable which would create a difference between General Ledger and Accounts Receivable. The sale has been made but the payment has not been received yet.

Bills Receivable In Accounting Double Entry Bookkeeping

Bills Receivable In Accounting Double Entry Bookkeeping

Cash AC or Bank AC.

Accounts receivable journal entry. Accounts receivable D r. When the company writes off accounts receivable under the allowance method it can make journal entry. To Sales on credit AC.

I have seen this however it states that there are a few accounts that you cant use when entering manual journals in Xero. 23 Learning Module on EL201 recorded chronologically by day. Ds account with the.

We recorded the journal entry for this as follows. Accounts Receivable Journal Entries. Accounts Receivable Journal Entry When you sell a product or service in exchange for a future cash payment you effectively have invoiced the client.

The Balance Sheet categorizes Account Receivables as a current asset because sales made on credit are expected to get. Overview of Accounts Receivable Journal Accounts Receivables are asset accounts in the books of the seller because the customer owes him an amount of money to. Accounts Receivable Journal Entry.

The account title and the amount credited 4. A journal entry contains the following items. Introduction of Accounts Receivable Journal Entry Explanation.

Carla makes these journal entries to reflect the sale which you can see below in which 700 is placed in both the Accounts Receivable and Sales Revenue rows. John Stewart on Mar012019. This journal entry increases the accounts receivable asset for ABC which appears as a short-term asset in its balance sheet.

Recording Sales of Goods on Credit. When the company sells the goods on credit the company still record sale on credit. In each case the accounts receivable journal entries show the debit and credit account together with a brief narrative.

For example on September 05 2020 the company ABC Ltd. Accounts receivable AR or receivables are the amount customers owe to the company for the goods delivered. Click here to skip the example below and go straight to the journal entry for receiving a payment from a debtor.

The accounts receivable journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable. When the cash is received at a later time an adjusting journal entry is made to record the payment for the receivable account. AR Accounts Receivable Collection Bookkeeping Explained.

Cash has been received by the business and needs to be debited. The uncollectible accounts expense debited in the above entry is closed into income summary account like any other expense account and the allowance for doubtful accounts credited in the above entry appears in the balance sheet as a deduction from the face value of accounts receivable. A simple way to find the original entry for the transaction is to do the following.

For a fuller explanation of journal entries view our examples section. Write off accounts receivable journal entry Allowance method. The accounting equation.

ABC Inc sold some electronic items to Mr. An accrued expense is the expense that has been incurred goods or services have been consumed before the cash payment has been made. Account Receivable Accounts receivable is the amount owed to us by the customers that have bought goods from us on credit ie.

Each entry made is called a journal entry. At the time of money received from the customer. In addition it increases sales which appear in ABCs income statement.

In this lesson were going to see what the journal entry is when our debtor accounts receivable actually pays us. Direct write off. Decide to write off Mr.

Account Receivable Collection Journal Entry Account Receivable Collection Journal Entry. Examples of Account Receivable Journal Entry. The accounting entry to record accounts receivables is.

Whenever a company provides goods or services to a customer and if the customer is willing to pay the. The account title and the amount debited 3. Journal entry to record the sales invoice-.

The revenue is recognized through an accrued revenue account and a receivable account. Issuing an invoice creates an accounts receivable meaning an account that you collect on later. The simplest form of journal is the two-column general journal and the process of recording in this book is called journalizing.

Accounts receivable is an asset. When a sale of goods or services is made to a customer you use your accounting software to create an invoice that automatically creates a journal entry to credit the sales account and debit the accounts receivable account. Journal Entries Related to Accounts Receivable At the time of recording a credit sale and billing the customer.

These include system accounts accounts receivable accounts payable retained earnings The 2 accounts I need help with adjusting are accounts receivables and payablesAre there any other ways of doing this. Related Journal entry for recovery of bad debts. Accounting Equation for Account Receivable Collection Entry.