What is the cost of goods sold. Therefore the Cost Of Goods Sold for the business will be 2500 1000 2000 500.

Cost Of Goods Manufactured Cogm How To Calculate Cogm

Cost Of Goods Manufactured Cogm How To Calculate Cogm

Steps in Calculating the Cost of Goods Sold.

Calculate cost of goods sold. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Then subtract the cost of inventory remaining at the end of the year. Calculating cost of goods sold in construction is pretty easy.

Cost of goods sold COGS is calculated by adding up the various direct costs required to generate a companys revenues. The cost of goods sold equation might seem a little strange at first but it makes sense. COGS Beginning Inventory Purchases During the Period Ending Inventory Your beginning inventory is whatever inventory is left over from the previous period.

Anthonys cost of goods sold would be calculated using the COGS formula shown above. Cost of Goods Sold Beginning Inventory Purchases - Ending Inventory For example if a business has a beginning inventory worth of 200000 and ending inventory of 50000 with new purchases of 300000 the cost of goods sold can be solve with the above COGS formula. Cost of goods sold is the actual cost of goods to a distributor retailer manufacturer.

COGS 200000 300000 - 50000 450000. 61000 9400 - 47000 23400. Then add the cost of what you purchased during the period.

The cost of goods sold formula is calculated by adding purchases for the period to the beginning inventory and subtracting the ending inventory for the period. Your beginning inventory which is the total worth of all the inventory you have on hand at the start of the time period including raw materials for not-yet-assembled goods among other things. That means that for the month of May Anthonys cost of goods sold was.

Thus for the three units sold COGS is equal to 1875. However COGS doesnt include all the costs incurred while running the business. Calculate COGS by adding the cost of inventory at the beginning of the year to purchases made throughout the year.

Determine the Beginning Inventory. The costs that go into calculating the cost of inventory are. Once youve decided which indirect costs to include add up all the project related direct costs and the indirect costs you have identified.

Add Purchases of Inventory Items. The business can charge the Cost Of Goods Sold in its financial statements. This is multiplied by the actual number of goods sold to find the cost of goods sold.

The cost of goods will typically be shown in the companys profit and loss account. Gross Profit Margin when Revenue and Cost of Goods Sold are given calculator uses Gross Profit MarginRevenue-Cost of goods soldRevenue to calculate the Gross Profit Margin Gross Profit Margin when Revenue and Cost of Goods Sold are given is the total gross profit compared to your net sales when the value for revenue and cost of goods sold is provided. Basic Calculation for Cost of Goods Sold.

It mainly includes direct and indirect costs incurred in making the finished product. The final number will be the yearly cost of goods sold for your business. It is deducted from sales revenue to calculate a gross profit of the company.

One way to calculate the cost of goods sold is to aggregate the period-specific expense listed in each of the general ledger accounts that are designated as being associated with the cost of goods sold. This is the total amount spent for the products you placed in your inventory for selling purposes. Beginning Inventory Costs Additional Inventory Cost Ending Inventory Cost of Goods Sold.

Before you can calculate your cost of goods sold you need to gather information on three crucial figures over a given time period. They calculate this by using the cost of goods sold formula. To find the cost of goods sold during an accounting period use the COGS formula.

COGS is an expenditure which is found in an income statement profit and loss statement. Determine the Ending Inventory. In the above example the weighted average per unit is 25 4 625.

How to calculate the cost of goods sold. Specific identification is special in that this is only used by organizations with specifically identifiable inventory. It is also likely to be important for tax filings.

Cost of Goods Sold COGS is the calculation of the total cost incurred in getting the product ready for sale in the market. Importantly COGS is based only on the costs that are directly utilized in. The cost of goods sold is subtracted from the reported revenues of a business to arrive at its gross margin.

Determine Direct and Indirect Costs. Its closing balance for goods at the end of the period was 500. Cost of goods sold COGS is literally the cost of producing the goods a company then sells.

You can calculate accounting cost by subtracting your expenses from your revenue. The result should be close to 1.

Indirect Cost Calculation And Process About Ala

Breakeven Formula Profit 0 sales variable costs fixed costs Target Net.

Formulas of cost accounting. Conversion Cost Direct material Factory overhead. The above mentioned is the concept that is elucidated in detail about Accounting Formulas for the Commerce students. Factory cost Direct material Direct labour Factory overhead.

An important part of standard cost accounting is a variance analysis which breaks down the variation between actual cost and standard costs into various components volume variation material cost variation labor cost variation etc so managers can understand why costs were different from what was planned and take appropriate action to correct the situation. When you subtract your fixed costs from contribution margin the amount left over is your profit. You multiply your sales per unit by units sold.

When you understand and use these foundational formulas youll be able to analyze a products price and increase profits. You can print it out and use it on the proctored. At the 1000-unit production level the total cost of the production is.

Financial accounting is primarily concerned with record keeping directed towards the preparation of Profit and Loss Account and Balance Sheet. The breakeven point is the level of sales where your profit is zero. To reduce and eliminate costs in a business you need to know the formulas that are most often used in cost accounting.

Subtract the cost of goods and services from net sales. If not the company is losing an. Materials price usage variance Actual quantity used Actual price Actual quantity used Standard price materials quantity usage variance formula.

Accounting 303 covers many aspects of cost accounting so this is a formula sheet with the information in one place for ratios and calculations. Economic costs represent any what-if scenarios. B Cost accounting is a science and arts both.

Cost accounting is a practice of cost control which is as follows-a Cost accounting is a branch of systematic knowledge that is a discipline by itself. Mathematically it is represented as Total Cost Total Fixed Cost Total Variable Cost. It consist its own principles concepts and conventions which may vary from industry to industry.

The breakeven formula is sales minus variable cost minus fixed cost. Beginning inventory value Purchases of inventory Ending inventory value Cost of goods sold. Cost pool total Cost driver The result will be a dollar amount that can then be multiplied by the number of products manufactured to obtain a total product cost for that cost pool.

It provides information regarding the. Materials purchase price variance Formula. 10 Average fixed cost 3 Average variable cost x 1000 Units 13000 Total cost.

Cost accounting formulas Net sales percentage. By the number of goods produced. Cost Accounting Formulas And Terminologies 1.

It is the source of all other functions of cost accounting as we can calculate the cost of sales per unit for a particular product. A calculation used in activity-based costing for determining the costs associated with activities based on particular time-based processes. Prime cost Direct material consumed Direct labour.

Divide net sales by gross sales. Example of the Total Cost Formula A company is incurring 10000 of fixed costs to produce 1000 units for an average fixed cost per unit of 10 and its variable cost per unit is 3. The formula for total cost can be derived by adding the total fixed cost to the total variable cost.

Materials purchase price variance Actual quantity purchased Actual price Actual quantity purchased Standard price Materials price usage variance formula. Sales Cost of goods sold Gross profit. The first function is to control the cost within the budgetary constraints management has set for a particular product or serviceIt is essential since management allocates limited resources to specific projects or production processes.

Prime Cost Direct Material Direct Labor2. The result as a percentage of net sales should be. Accounting costs represent anything your business has paid for.

The following formulas can be used to find out different costs. Beginning balance net income net losses dividends ending balance. Cost Accounting is a branch of accounting and has been developed due to limitations of financial accounting.

Financial Accounting Cost Accounting and Management Accounting 1 - 22 Study Note 2 Material Control 23-48 Study Note 3 Labor Cost Computation and Control 49-88 Study Note 4 Overheads 89-118 Study Note 5 Methods of Costing-Job Batch and Contract Costing 119-146 Study Note 6.

This result tells you that the factorys output of chocolate milk during the year cost 18000. The COGM amount is transferred to the finished goods inventory account during the period and is used in calculating cost of goods sold on the income statement.

Cost Of Goods Manufactured Formula How To Calculate Cogm

Cost Of Goods Manufactured Formula How To Calculate Cogm

Next determine the beginning and ending inventories.

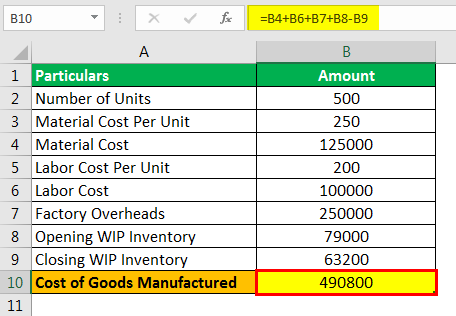

How to calculate cost of goods manufactured. First setting the selling price of the product. The formula and format for presenting the cost of goods manufactured is. Direct materials used.

Calculate the total manufacturing overhead. Beginning Work in Process WIP Inventory. Thus the total cost of goods manufactured for the period would be 265000 100000 50000 125000 65000 75000.

Beginning Inventory of Finished Goods Add. The cost of the direct materials used PLUS the cost of the direct labor used PLUS the cost of manufacturing overhead assigned. Holtzman PhD CPA is Chair of the Department of Accounting and Taxation at Seton Hall University.

Material Cost 491250 x 100 49125000. Cost of goods manufactured 1000 x 2 2000 Cost of goods sold 600 x 2 1200 2000 - 1200 800 3. Next determine the overhead.

To compute cost of goods manufactured just apply the outputs formula. Ending Work in Process WIP Inventory COGM. Httpbitly2DfGBXuThe cost of goods manufactured statement displays the cost of products manufactured in a period b.

Calculating the cost of goods manufactured is useful for controlling operations and making some operating decisions. COGM is comprised of all costs related to making the finished products including. The formula to calculate the COGM is.

How to calculate the Cost of Goods Manufactured. Calculate the cost of goods manufactured. First we need to reach the direct labor cost by multiplying what is given Direct Labor Cost 10 100 500 500000 Total Manufacturing Cost 100000 500000 60000 660000.

To calculate the cost of goods manufactured you must add your direct materials direct labor and manufacturing overhead to get your businesses total manufacturing cost. Calculation of the Cost of Goods Sold for a Manufacturer The calculation of the cost of goods sold for a manufacturing company is. Example Calculation of Cost of Goods Manufactured COGM This can be more clearly seen in a T-account.

Full Crash Course on Udemy for 999. Specifically management usually uses it to. If this cost is not calculated correctly it can break a business.

Cost of Goods Manufactured Equals. The following is the formula used to calculate the cost of goods manufactured. Cost of Goods Manufactured Example First determine the costs.

Therefore the calculation of the cost of goods manufactured is as follows 49125000 37800000 43750000 29862000 23889600. Beginning Inventory at the beginning of the year Plus Purchases and Other Costs Minus Ending Inventory at the end of the year. COGM Beginning work in process WIP inventory Total manufacturing cost - Ending WIP inventory In this formula beginning work in process inventory refers to the value of products that are in production but not yet completed.

This means that Steelcase was able to finish 265000 worth of furniture during the period and move this merchandise from the work in process account to the finished goods account by the end of the period. About the Book Author Mark P. You can calculate the direct material costs by taking the beginning raw materials inventory adding the cost of the raw materials purchased and subtracting the ending raw materials inventory.

The cost of goods manufactured is the cost per unit of product manufactured work performed or service rendered. Next you will add the beginning work-in-process and subtract the ending work-in-process from the total manufacturing cost to get the cost of goods manufactured. Calculate the material and direct labor costs associated with production.

Calculate the value of the. Labor Cost 378000 x 100 37800000. Finished Goods Available for Sale Subtract.

Direct labor used. The basic formula for cost of goods sold is. Under the cost-based pricing method information on the cost of goods manufactured per unit is important for determining a products.

Ending Inventory of Finished Goods Equals. Otherwise it is the price of the resources of your enterprise spent on making the product appear. Rosemary Njeri Cost of goods manufactured COGM is a term that refers to a schedule or statement that shows the total production costs for a company during a specific period of time.