How to calculate contribution Margin from Balance Sheet. The contribution margin sometimes used as a ratio is the difference between a companys total sales revenue and variable costs.

7 1 Exploring Contribution Margin Financial And Managerial Accounting

7 1 Exploring Contribution Margin Financial And Managerial Accounting

Contribution margin revenue variable costs For example if the price of your product is 20 and the unit variable cost is 4 then the unit contribution margin is.

How to find contribution margin. An important point to be noted here is that fixed costs are not considered while evaluating the contribution margin per unit. The actual calculation of contribution margin may be more laborious but the concept applies. Net the gross sales amount against any deductions such as for sales allowances to arrive at the net revenue figure.

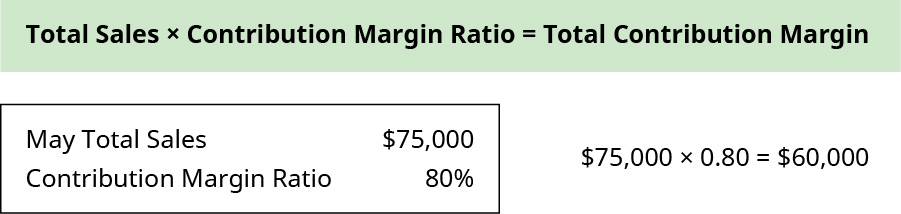

The contribution margin ratio can help companies calculate and set targets for the profit potential of a given product. The formula for contribution margin is simple and just involves a little subtraction. The 600000 is the amount left over to pay fixed costs.

You need to work out the contribution margin per unit the increase in profit if there is a one unit increase in sales. Work out contribution. This left-over value then contributes to paying the periodic fixed costs of the business with any remaining balance contributing profit to the owners.

The contribution margin per unit is calculated as. Contribution margin per unit measures how the sale of one additional unit would. Examples of these costs.

We can use the contribution margin formula to find out what this means for their bottom line. Thus the calculation of contribution per unit is. In other words the contribution margin equals the amount that sales exceed variable costs.

This is the sales amount that can be used to or contributed to pay off fixed costs. For example say you produced 105000 shirts. How to Compute Contribution Margin Figure total contribution margin.

To calculate the contribution per unit summarize all revenue for the product in question and subtract all variable expenses from these revenues to arrive at the total contribution margin and then divide by the number of units produced or sold to arrive at the contribution per unit. Total contribution margin measures the amount of contribution margin earned by the. Calculate contribution margin per unit.

Contribution margin is the amount left-over after deducting from the revenue the direct and indirect variable costs incurred in earning that revenue. Contribution margin is equal to sales revenue less total variable expenses incurred to earn that revenue. Use the following formula to calculate the contribution margin ratio.

The contribution margin for this example would be the difference of 1000000 and 400000 which is 600000. This is the total amount you received from selling the product. Total variable expenses include both manufacturing and non-manufacturing variable expenses.

The steps to follow to calculate contribution margin for a specific sale transaction are as follows. To calculate the total contribution margin start with the sales revenue generated by a product. Aggregate all variable costs associated with the sale.

Also it is important to calculate the contribution margin to know the price at which you need to sell your goods and services to earn profits. The difference between sales price 200 and variable cost per unit 130. The contribution margin is the difference between sales and variable costs.

Its a simple calculation. The contribution margin for Tennis shoes is easiest to calculate. In the Dobson Books Company example the contribution margin for selling 200000 worth of books was 120000.

How to Calculate Contribution Margin Contribution Margin Formula. 20 10 10 It simply means that by selling this cupcake the net income or profit increases by 10. In a service firm contribution margin is equal to revenue from provision of services less all variable expenses incurred to provide such services.

So if the price of your product is 25 and the unit variable cost is 5 the units contribution margin is 20. Hence the contribution margin per additional unit of the cupcake will be. The result is the margin.

It equals 70 ie. Contribution Margin For More video link given below of Playlist link Balance Sheet. From that amount subtract the total variable costs in the production run.

The amount thats left over is the combination of fixed expenses and profit. Contribution margin ratio contribution margin sales where contribution margin sales minus variable costs. A per product margin can be found by dividing 600000 by the number of units sold.

Generally speaking you want your contribution margin to be as high as possible. This was calculated using the following formula. 50000 20000 30000 While the contribution margin is 30000 the businesss fixed costs premises staffing insurance etc mean that the company is making a net loss of 10000.

Total contribution margin TCM is calculated by subtracting total variable costs from total sales. In the Dobson Books Company example the contribution margin for selling 200000 worth of books was 120000.

In other words calculating the contribution margin determines the sales amount left over after adjusting for the variable costs of selling additional products.

Formula for total contribution margin. Contribution Margin Calculator Click Here or Scroll Down The formula for contribution margin is the sales price of a product minus its variable costs. Contribution per unit x number of units sold. Selling price per unit 30.

You calculate it by using this formula. Formula for Contribution Margin In terms of computing the amount. Variable cost per unit 18.

Contribution Margin Net Sales - Variable Costs Contribution Margin Per Unit Sales Price Per Unit - Total Variable Costs Per Unit Contribution Margin Ratio Contribution Margin Per Unit Sales Price Per Unit. The contribution margin per unit is calculated as. The formula for contribution margin dollars-per-unit is.

Following is the contribution margin formula on how to calculate contribution margin. Total Contribution Margin Sales - Total Variable Costs. The contribution margin is the difference between sales and variable costs.

Total Contribution Margin is calculated using the formula given below Contribution Margin Net Sales Total Variable Expenses Contribution Margin No. Contribution margin per unit formula would be Selling price per unit Variable cost per unit 6 2 4 per unit. 30 less 18 Units sold 15000.

Using the formulae we can perform the following calculation. The contribution margin formula is calculated by subtracting total variable costs from net sales revenue. Calculate Contribution Margin Ratio.

So if the price of your product is 25 and the unit variable cost is 5 the units contribution margin is 20. Total contribution margin Total sales Total variable costs To determine overall profitability compare total contribution margin to fixed costs. Calculating the contribution margin of a company is a simple process as all you need to do is subtract the total variable costs from the net sales revenue figure of a business.

Contribution ratio would be Contribution Sales 200000 300000 23 6667. Contribution Margin Total Sales Revenue Total Variable Cost. In other words total contribution may be obtained by multiplying the per unit contribution to the volume of sales.

It can be calculated by dividing total contribution margin CM by total units sold Q. Lets look at a simple worked example of contribution. Contribution Margin Net Sales Variable Costs Contribution Margin Formula Components.

Contribution per unit 12 ie. The contribution margin per shoe is 500000 250000 200000 10000. Aggregate all variable costs associated with the sale.

Net Sales of 450000 minus the variable product costs of 130000 and the variable expenses of 30000 for a Contribution Margin of 450000-130000-30000 290000. Total contribution can also be calculated as. Of Unit Sold Sales Price per Unit No.

You can also express the contribution margin as a percentage by using the following formula. The amount thats left over is the combination of fixed expenses and profit. Total revenue variable costs of units sold For example a company sells 10000 shoes for total revenue of 500000 with a cost of goods sold of 250000 and a shipping labor expense of 200000.

Contribution margin presented as a or in absolute dollars can be presented as the total amount amount for each product line amount per unit product or as a ratio or percentage of net sales. Here is some information about a business that just sells one product. The steps to follow to calculate contribution margin for a specific sale transaction are as follows.

The Contribution Margin Ratio is 644 290000 divided by 450000. The Formula for Contribution Margin Is The contribution margin is computed as the difference between the sale price of a product and the variable costs associated with its production and sales. Contribution would be 4 50000 200000.

The companys Contribution Margin is. Net the gross sales amount against any deductions such as for sales allowances to arrive at the net revenue figure. This was calculated using the following formula.

Contribution 180000 ie. Contribution Margin Net Sales Revenue Variable Costs. The last step is to calculate the contribution margin ratio.

12 x 15000 units. Contribution margin per unit equals sales price per unit P minus variable costs per unit V. Breakeven point in dollars equals total fixed costs divided by contribution margin ratio and breakeven point in units of sales equals total fixed costs by contribution margin per unit.

Of Unit Sold Variable Cost per Unit Total Contribution Margin 10000 units 100 10000 units 65. Total contribution margin measures the amount of contribution margin earned by the company as a whole. We know that contribution is the excess of sales over variable cost which is also known as total margin distinguished from profit.

Mathematically it is represented as Unit Contribution Margin Sales Total Variable Cost No. Contribution per unit describes how the sale of one unit affects a companys net income.

:max_bytes(150000):strip_icc()/NetProfitMarginFormulas-5c536ea9c9e77c00016b2716.jpg) What Is The Formula For Calculating Profit Margins

What Is The Formula For Calculating Profit Margins

Calculate the overall revenue of the product.

Contribution margin per unit calculator. Of Unit Sold Sales Price per Unit No. It tells us what percentage the contribution margin of sales revenue is. Contribution Margin Per Unit Per Unit Selling Price.

To calculate your per-unit contribution margin divide the total margin by the number of units produced. Contribution Margin Calculator - calculate contribution margin which is the differences between a companys net sales and variable costs. Its also common for management to calculate the contribution margin on a per unit basis.

Contribution per unit is also known as contribution margin per unit. To find the unit contribution margin subtract each stuffed animals selling price from its variable costs. The Contribution Margin Per Unit Calculator calculates the contribution margin per unit and contribution margin ratio.

The basic formula for contribution per unit is total revenue minus total variable costs divided by the total units. Divide this number by your revenue per unit to express it as a percentage of revenue. Of Unit Sold Variable Cost per Unit Total Contribution Margin 10000 units 100 10000 units 65 Total Contribution Margin 1000000 650000 Total Contribution Margin 350000.

Contribution margin per unit on this gadget equals 60 100 40 60. If Variable Cost Is 50000 And Fixed Cost Is 30000 Then Operating Income Would Be 180000 2160000 316000 420000 11. Find Contribution Margin Per Unit Subtract your total cost per unit from your revenue per unit to get your contribution margin per unit.

The ratio of contribution margin to sales revenue. Enter contribution margin and sales in the below calculator and click calculate to find its contribution margin ratio. Contribution Margin No.

In the example dividing the margin of 170000 by the 105000 shirts you produced gives you a unit margin of 162 per shirt. To calculate the contribution per unit summarize all revenue for the product in question and subtract all variable expenses from these revenues to arrive at the total contribution margin and then divide by the number of units produced or sold to arrive at the contribution per unit. Contribution margin ratio is nothing but the percentage of sale for the given contribution margin.

How to calculate contribution Margin from Balance Sheet. Accordingly the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price. You can use these same methods to evaluate various product or business lines just group your numbers accordingly.

Therefore selling the gadget increases net income by 60. Contribution Margin Per Unit. Contribution margin per unit Sales price per unit Variable costs per unit Say a company sells a single gadget for 100 and the variable cost of making the gadget is 40.

This metric is typically used to calculate the break even point of a production process and set the pricing of a product. It can be computed by either dividing contribution margin per unit by the sales revenue per unit or total contribution margin by total sales revenue for a specific period. Online Contribution Margin Calculator.

Contribution Margin Per Unit Is Multiplied To Number Of Units Sold To Calculate 1revenue Margin 2variable Margin 3contribution Margin 4divisor Margin 10. Which can be calculated using the formula. Contribution margin as a percentage of sales revenue.

Contribution margin ratio when expressed in percentage is known as contribution margin percentage. The contribution margin per unit represents the incremental money generated for each productunit sold after deducting the variable portion of the firms costs is calculated using Contribution Margin per UnitSales Price per Unit-Variable Cost per Unit. Calculate the unit contribution for each product line to find the margin.

Contribution Margin For More video link given below of Playlist link Balance Sheet. To calculate Contribution Margin per Unit you need Variable Cost per Unit V and Sales Price per Unit SP. Unit Contribution Margin Selling Price per Unit Variable Cost per Unit Alternately the formula for UCM can be expressed as the difference of sales and total variable cost divided by the number of units sold.

Hence the contribution margin per additional unit of the cupcake will be. With our tool you need to enter the respective value for Variable Cost per Unit and Sales Price per Unit and hit the calculate button. Use our online contribution margin ratio calculator to get the output instantly.

An important point to be noted here is that fixed costs are not considered while evaluating the contribution margin per unit. Thus the calculation of contribution per unit is. This formula shows how much each unit sold contributes to fixed costs after variable costs have been paid.

20 10 10 It simply means that by selling this cupcake the net income or profit increases by 10. In other words contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost.